Deciphering Market Sentiment: Reading Nifty Option Chain Data

In the intricate world of financial markets, understanding and interpreting market sentiment is a critical skill for successful trading. One valuable tool for gauging market sentiment, especially in the context of the Indian stock market, is the Nifty Option Chain. This comprehensive display of call-and-put options for the Nifty index provides traders with key insights into the expectations and perceptions of market participants. Let’s delve into how reading Nifty Option Chain data can help decipher market sentiment. Check on how to make demat account?

Understanding the Nifty Option Chain:

The Nifty Option Chain is a detailed listing of available call and put options for the Nifty index. It includes various strike prices and expiration dates, offering a snapshot of the trading landscape. Each option contract within the chain represents the right to buy (call option) or sell (put option) the Nifty index at a specified price (strike price) before or at the expiration date.

Key Components of the Nifty Option Chain:

Strike Prices: The Nifty Option Chain presents a range of strike prices, allowing traders to choose options based on their market outlook. These strike prices indicate the levels at which options can be exercised. Check on how to make demat account?

Expiration Dates: Multiple expiration dates are listed, giving traders the flexibility to plan strategies over different time horizons. Each expiration date represents the period during which the option can be exercised.

Call and Put Options: Traders can select between call and put options based on their market expectations. Calls are typically used for bullish bets, while puts are employed for bearish bets.

Premium: The price of an option, known as the premium, reflects the cost of buying that option. Various factors influence the premium, including the current Nifty index level, time to expiry, volatility, and interest rates. Check on how to make demat account?

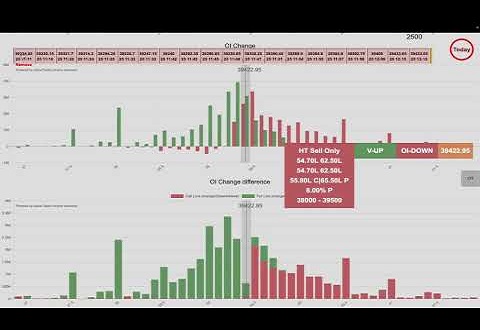

Open Interest (OI): OI represents the total number of outstanding options contracts for a specific strike price and expiration date. High OI indicates increased market interest and liquidity, providing insights into potential support or resistance levels.

Implied Volatility (IV): IV is a measure of the market’s expectations for future price volatility. High IV results in higher option premiums, while low IV leads to lower premiums.

Deciphering Market Sentiment through Nifty Option Chain:

Spotting Support and Resistance Levels:

High Call OI: An elevated OI in call options at a specific strike price suggests potential resistance. Traders often interpret this as an indication that market participants expect the Nifty index to face difficulty surpassing that level. Check on how to make demat account?

High Put OI: Conversely, a high OI input options at a certain strike price implies potential support. Market participants may anticipate that the Nifty index will find buying interest near that level.

Conclusion:

Deciphering market sentiment through the Nifty Option Chain is an invaluable skill for traders navigating the Indian stock market. By analyzing key components such as OI, IV, and options activity, traders can gain a nuanced understanding of market expectations and potential price movements. However, it’s essential to approach this analysis with a combination of technical expertise, fundamental understanding, and risk management discipline. Check on how to make demat account?